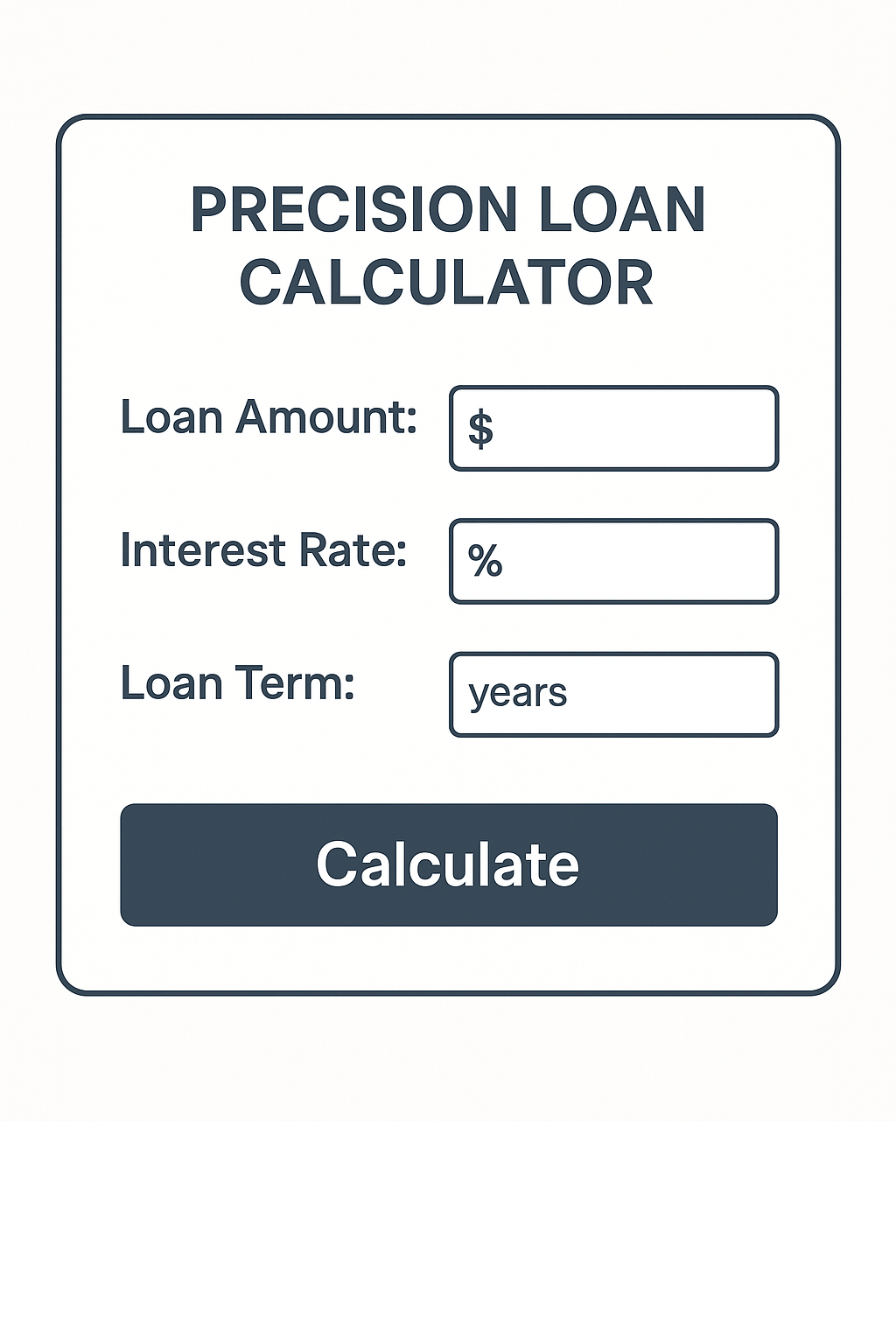

Precision Loan Calculator

Calculate your loan payments with detailed breakdown

| Payment # | Payment | Principal | Interest | Balance |

|---|

Table of Contents

The Ultimate Guide to Loan Calculators: how They Work And The Need For best Loan Calculator

Extreme Direct to Advance Calculators:

How They Work and Why You Would Want One

Presentation

In this era of instant financial behaviors, making well-informed choices for borrowing becomes imperative. Whether it’s for the purchase of a home, a car, or a personal loan, understanding the commitment of repayment becomes pivotal. This is where one really needs a credit calculator. no,1Loan Calculator

In this extensive guide, we will cover:

✅ A credit calculatore

✅ How credit calculations work

✅ Different types of advance calculators

✅ How using one can save you money

✅ A few tips on how to get the best advance terms

By the end of it, you will have the capacity to make more intelligent monetary choices.

What Is a best Loan Calculator?

The loan calculator is a digital instrument that assists a borrower in estimating his monthly payments, interest totals, and repayment schedule based on:

Loan Amount (principal)

Interest rate (APR)

Term of Loan (repayment period)

Why Use a Loan Calculator?

✔ Budget – To see how much the monthly payments figure into your finances.

✔ Comparative- See loan offers by various lenders.

✔ Planning- Know how much interest you incur over the long run.

✔ Negotiation- Make use of calculations to secure better rates.

In general, these credit calculators use some mathematical equations to extract the information related to repayments. The most widely used of these formulas is the amortization that calculates the amount for monthly installments on a fixed schedule.

Loan Payment Formula /Precision Loan Calculator

The general formula for calculating the fixed monthly payment is as follows:

Where

P = Principal loan amount

r = Monthly interest rate (annual interest rate/12)

n = Number of payments (term of the loan in months)

Example Calculation

For example, you borrowed $10,000 at an APR of 5.5% for 5 years or 60 months.

Monthly interest rate=5.5%÷12=0.458%or0.00458

Monthly payment=$191.01

Total interest paid=$1,460.51

Advance calculators/

Different borrowings will require unique calculations. Here are the different types of the above:

- Home Loan Calculator

Estimates a domestic advance installment calculate.

Incorporates property charges & protections (PITI).

Makes a difference comparing 15-year with 30 and 15 with 30 contracts.

- Auto Credit Calculator

Figures out auto loan repayment.

Includes down payment and trade-in values.

Shows how the term can change intererst.

- Personal Loan Calculator

Calculates unsecured cash holed-breathing capacities.

Good for debt consolidation.

Helps most people between fixed and fluctuating rates.

4 : Student The Precision Loan Calculator

Forecasts payments for both government and private student loans.

Includes income-based repayment options.

Demonstrates the effect of loan forgiveness.

- Credit Card Payoff Calculator

Calculates the time taken to repay the debt.

Shows the least payment vs. accelerated payoff.

Calculates interest savings.

Why You Should Always Use a Credit Calculator

- Keep Away from Too Much Borrowing

Most borrowers borrow more than what they actually need, which leads them into a lot of financial problems. A loan The Precision Loan Calculator helps you only borrow what you can afford to pay. - Compare Lenders Effectively

Banks and online lenders advertise different rates. By inputting different terms, you will:

✔ Find the lowest APR

✔ Choose the best repayment period

✔ Avoid hidden costs

- Early Payoffs Pay Off

Paying extra monthly lowers interest. A loan calculator demonstrates:

How additional payments shorten loan terms

Total interest savings

- Understand Amortization

An amortization schedule breaks down each payment into:

Principal (the reducing debt)

Interest (cost of borrowing)

This helps to visualize how loans work over time..

Guide on Getting Favorable Credit Terms

- Develop Your Singles

Next credits above 700 guarantee lower interest rates. Measure rating several times before actually applying. - Choose the Correct Loan Term

Shorter term = Less interest but higher principal and interest payments

Longer term = Lesser principal and interest payments but more interest

- Make a Larger Down Payment

A down payment of 20% or more would lessen the loan amounts and interest. - Negotiate with Lenders

Use the returns from credit calculators to ask for better rates. - Consider Refinancing

Lowering your monthly payments is an option if you can refinance at lower interest rates falling asleep.